Arizona Spousal Support Calculator - The California alimony (alimony) calculator calculates temporary alimony in California. To calculate temporary alimony amounts, the California Alimony Calculator determines (1) the net income of the spouses by subtracting US and California income taxes from the gross income of the spouses, (2) applies additional deductions for child support and related net income. expenses and (3) applies the selected California alimony formula to the spouses' net incomes. Although the California maintenance calculator does all this for you with one click of the mouse, you must enter the relevant information into the calculator.

First, you must enter the gross income of the spouses. Enter the gross income in the appropriate entries on the California Child Support Calculator form. Gross income must be entered in dollars without letters or special characters such as dollar signs or commas.

Arizona Spousal Support Calculator

The California alimony calculator uses the gross incomes entered into the calculator inputs to calculate the spouses' net incomes. Spousal net income is calculated by subtracting US and California income taxes from the spouses' gross income and making additional deductions from the net income, such as child support and related expenses.

How Is Arizona Child Support Calculated?

Second, you must choose the spouses' tax filing statuses. The tax return filing statuses correspond to the filing statuses available in the US and California. Available statuses are: single, head of household, married jointly and married separately.

The California Alimony Calculator uses the selected income tax filing states to calculate the spouse's US and California income taxes. To determine the net income, the income tax of each spouse is subtracted from their gross income.

Third, you must choose whether each spouse has primary responsibility for their own living expenses. Choose one of the two available options.

If a spouse is primarily responsible for their own living expenses, the spouse is eligible for an exemption from California income tax, and the California alimony calculator will reduce the spouse's total California income tax liability.

Understanding Spousal Maintenance In Arizona

Fourth, you must enter the number of dependents for each spouse. Enter the number of dependents in the appropriate fields on the California Child Support Calculator form. The number of dependents must be entered as whole numbers without letters or special characters.

The California child support calculator uses the number of dependents entered in the calculator input to calculate the California income tax exemption amount. The California alimony calculator reduces a spouse's total California income tax liability

Fifth, you must enter the amount each spouse pays for child support and related expenses. Enter child support and related expenses in the appropriate entries on the California Child Support Calculator form. Amounts must be entered in dollars without letters or special characters such as dollar signs or commas.

The California alimony calculator uses the child support and related expenses entered in the calculator inputs to further reduce the spouses' net incomes. Alimony is calculated from net income not allocated to alimony and related expenses.

Using The Arizona Child Support Guidelines

Sixth, you need to enter the duration of the spouses' marriage. After determining the length of marriage, enter the length in the appropriate input field on the California Support Calculator form. Length must be entered in years without letters or special characters.

The California alimony calculator uses the length of marriage entered in the calculator input to calculate the length of alimony in California. Although there is no formula for the length of alimony set forth in California law, the general rule in California is that the length of alimony lasts half the length of the marriage.

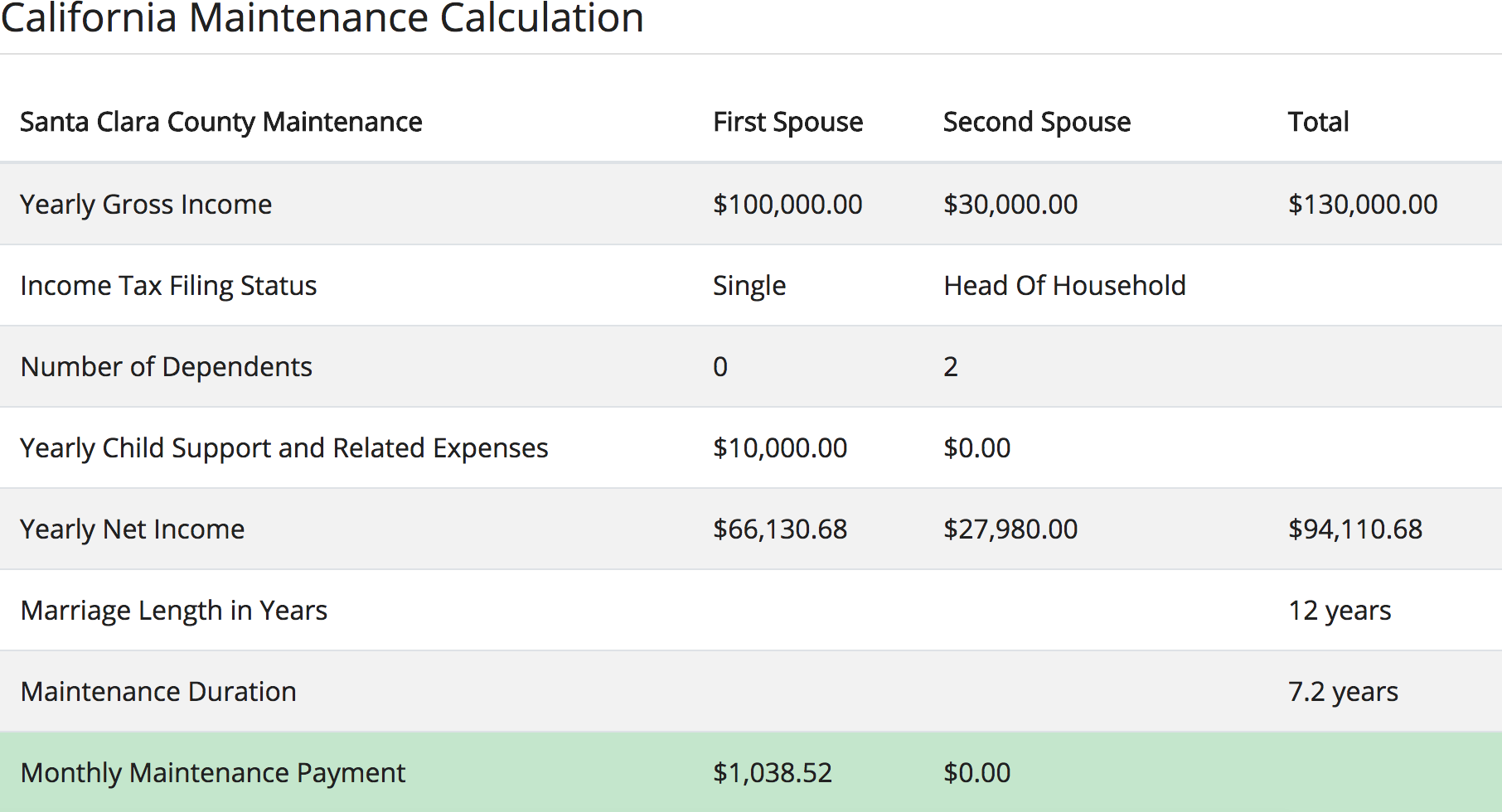

Seventh, you must select the California Temporary Support Formula from the available formulas. The California Maintenance Calculator allows you to choose from three California county formulas set forth by local court rules. These counties are: Alameda County, Marin County, and Santa Clara County.

The California maintenance calculator uses the selected interim maintenance formula to calculate California maintenance. Each county has a different formula for paying temporary child support. The Santa Clara County formula became the most widely used in California.

Tax Consequences For Spousal Maintenance

The Alameda County District Court Rules provide for the Alameda County Temporary Child Support Formula. According to the Alameda formula, the amount of alimony depends on whether the alimony recipient also receives child support from the alimony payer.

In cases where the alimony recipient does not receive child support from the alimony payer, the amount of alimony is calculated by taking 40% of the paying spouse's net income minus 50% of the alimony recipient's spouse's net income. In cases where the alimony recipient also receives alimony for a child from the alimony payer, 35% of the paying spouse's net income (after deduction of alimony) minus 40% of the spouse's net income (without the addition of alimony) is taken into account when calculating the alimony amount. ).

The El Dorado County Circuit Court Rules provide for the El Dorado County Temporary Child Support Formula. The El Dorado formula is a hybrid formula in that it provides a general support formula and then transitions to the Alameda County formula if support is paid by one custodial parent for the children of the relationship.

Under the El Dorado formula, temporary alimony is calculated by taking 40% of the dependent spouse's net income minus 50% of the dependent spouse's net income. However, if one custodial parent pays child support for the children of the relationship, temporary child support payments are calculated according to the formula adopted in Alameda County.

Calculating Virginia Maintenance

The Lake County District Court Rules provide for the Lake County Temporary Child Support Formula. The Lake County formula calculates alimony at 40% of the paying spouse's net income minus 50% of the recipient spouse's net income, adjusted for tax consequences.

The Marin County District Court Rules provide for the Marin County Temporary Child Support Formula. According to Marin's formula, the amount of alimony depends on whether the alimony recipient also receives child support from the alimony payer.

In cases where the alimony recipient does not receive child support from the alimony payer, the amount of alimony is calculated by taking 40% of the paying spouse's net income minus 50% of the alimony recipient's spouse's net income. In cases where the alimony recipient also receives alimony from the alimony payer, the amount of alimony is calculated by subtracting 45% of the alimony recipient's net income (without the addition of alimony) from the spouse's net income (after deduction of alimony). ).

The San Mateo County Local Court Rules provide the San Mateo County Temporary Child Support Formula. Temporary spousal support is generally calculated at 40% of the payer's net income, minus 50% of the recipient's net income, adjusted for tax consequences. If there is alimony, temporary spousal alimony is calculated from net income not allocated to cover alimony and/or child-related expenses.

Amount Child Support: Fill Out & Sign Online

The Santa Barbara County Local Court Rules provide the Santa Barbara County Temporary Child Support Formula. According to the Santa Barbara formula, alimony is calculated as 40% of the payer's net income minus 50% of the recipient's net income, adjusted for tax consequences. If there is alimony, the alimony of the temporary spouse or partner is calculated from the net income not allocated to cover alimony and/or child-related expenses. This formula is modeled after the Santa Clara Intermediate Care formula.

The Santa Clara County Local Court Rules provide the Santa Clara County Temporary Child Support Formula. The Santa Clara formula calculates alimony at 40% of the payer's net income minus 50% of the recipient's net income, adjusted for tax consequences. If there is alimony, the alimony of the temporary spouse or partner is calculated from the net income not allocated to cover alimony and/or child-related expenses.

Once the spouse's information is entered into the California Child Support Calculator and the child support formula is selected, click the "Calculate Child Support" button. It is! The page below the California Maintenance Calculator displays your California Maintenance Estimate.

The California maintenance calculation result is based on the selected county formula and includes relevant information for your maintenance calculation.

How Divorce Affects Your Taxes

If the California Alimony Calculator was submitted with incorrect information, the calculator will display error messages when validating incorrectly filled calculator inputs and the "Calculate Alimony" button will be disabled. In addition, error messages are displayed below the inputs to indicate the cause of the errors.

If you receive validation errors, please enter valid information in the calculator input containing the validation errors. When you enter new information, the validation error is removed from the updated calculator input. Once all validation errors are resolved, the Calculate Alimony button will be re-enabled to re-render the California Child Support Calculator. The Arizona alimony (alimony) calculator does Arizona alimony calculations with one click. However, before calculating alimony in Arizona, you must enter your gross income, age, and length of marriage into the calculator.

First, you must enter the gross income of the spouses. Enter the gross income in the appropriate fields on the Arizona Child Support Calculator form. Gross income must be entered in dollars without letters or special characters such as dollar signs or commas.

Arizona support

State Alimony Laws In All 50 States: Types, Calculation, Duration, & More

Pa spousal support calculator, my spousal support calculator, wisconsin spousal support calculator, military spousal support calculator, divorce spousal support calculator, spousal support calculator, colorado spousal support calculator, spousal support calculator ny, spousal support calculator canada, nc spousal support calculator, spousal support calculator arizona, ca spousal support calculator

0 Comments